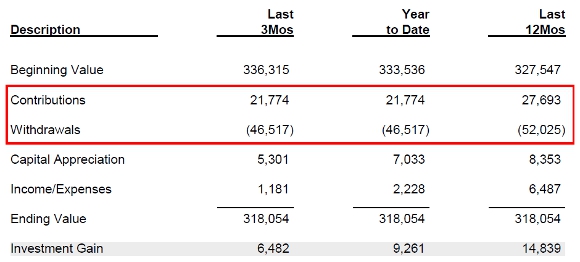

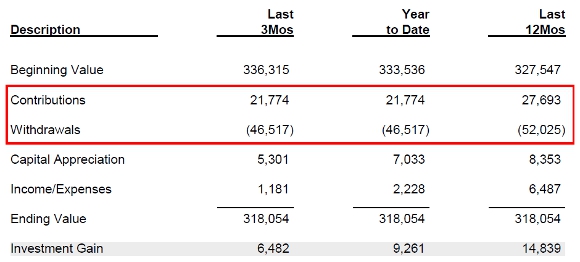

After receiving their PortfolioCenter quarterly reports, the most frequent question from clients usually concerns the net contributions/withdrawals. (“But I didn’t take out that much money?!“)

The total contributions and withdrawals on PortfolioCenter performance reports rarely matches the sum of the checks the client wrote or added during the period. While this is normal, there is no single PortfolioCenter report that details how net contributions were calculated. How then do you verify the numbers?

The total contributions and withdrawals on performance reports can usually be explained by three factors:

- The totals include the market value of transfers and receipts of securities during the time period.

- Expenses that reduce neither gross nor net returns are treated as withdrawals; typically this is federal and state withholding.

- Money moved between two accounts within the group may be counted both as a deposit and a withdrawal. Traditional reports may or may not omit intra-group flows depending on your settings. Presentation Studio reports omit intra-group flows by default.

For example, in the Performance report pictured above, the client complained that she had removed $25,000 from her accounts in the last 12 months, not the approximately $52,000 stated on the performance report.

To understand these numbers, run an Expense report and a Capital Flows and Valuations report on each account in the group for the the time period in question.

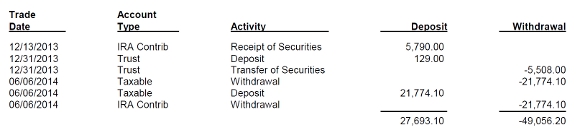

Reviewing the capital flows in her accounts shows:

1) She withdrew $21,774 from her IRA. The money was transferred into her taxable account and then sent to her by check on the same day. As shown below, this process creates 2 withdrawals (one from the IRA and one from the taxable account) and 1 deposit (into the taxable account).

2) Additionally, she rolled a mutual fund with a market value of $5,790 into her IRA from a different broker and gifted an individual stock with a market value of $5,508 from her taxable account. The market value of the receipt is included in the total deposits. The market value of the transfer is included in the total withdrawals.

With the capital flows report, we have verified the $27,693 total contributions, but the total withdrawals still fails to match. Time to review the Expense report.

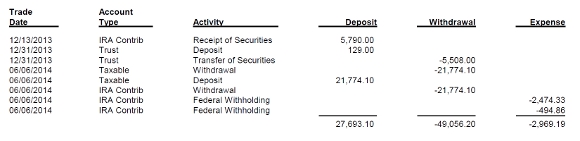

By default Federal Withholding reduces neither net nor gross returns and is treated as a withdrawal. The Expense report shows $2969.19 in withholding which verifies our final number ($49,056 + $2,969 = $52,025 total withdrawals).

Need help?