passPort by Arcons Technology

What do you do with 401ks or annuities that you’d like to track in PortfolioCenter but which are not available through your regular downloads? Is manual entry the only option?

Download everything you can

The best long term, most cost effective solution is to move everything you can to a place from which you can download. Schwab Performance Technologies interfaces directly with over 40 brokers and custodians. You may find they offer the interface you need.

Additionally, many 529 plans, variable annuities, REITS and DPPS can be downloaded through DST Fanmail.

If you have a significant amount of manual entry, it may be cost effective to subscribe to a service (e.g. ByAllAccounts and Advisor Exchange LLC) that aggregates the data for you.

Consider passPort

However the most innovative and cost effective solution for data aggregation I’ve encountered is passPort by Arcons Technology.

How it works

PassPort works with Quicken. First, you download your data into Quicken. (An ever-increasing number of sites offer a Quicken download or a CSV download which Quicken accepts). If your sites do not offer a Quicken download, you can manually enter the data into Quicken and download the prices.

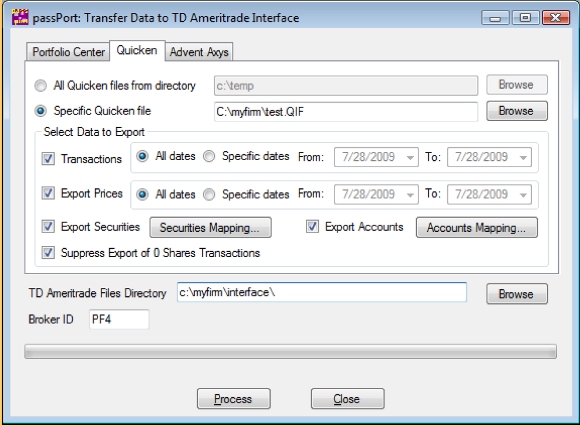

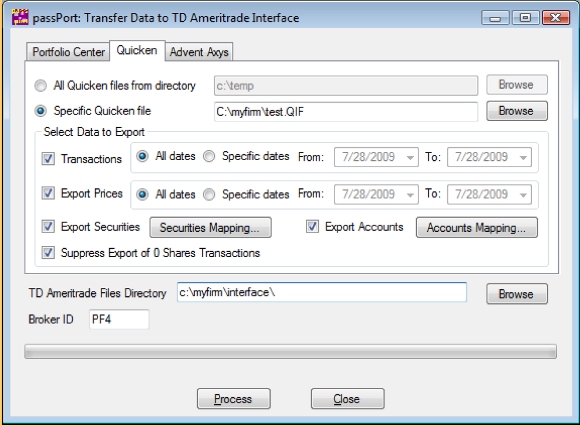

Next, export the new data from Quicken. Open the Quicken export file in passPort and ask passPort to create files which can then be posted into PortfolioCenter through the Generic interface.

Pros & Cons

Essentially, passPort turns your manual entry into downloaded entry. Since you reconcile the data in Quicken before it ever hits PortfolioCenter, you greatly decrease the chances of corrupting your PortfolioCenter data.

This process does require knowing your clients user ids and passwords. However, if your clients enter their login information directly into Quicken during a visit to your office, you would never see it. Quicken stores the information and all you would see is *****. Your clients will need to update the information should they change it, but the SEC will be happier if you don’t control of the passwords.

The first time you use passPort it requires a fair amount of setup time as you must create your Quicken accounts and securities and map them to PortfolioCenter. But this work is only done once. After that, depending on how you setup Quicken, you can update all your accounts with 1-click.

After seeing a demo of passPort, I tested it for a month on a trial basis. I couldn’t break it — even when I tried to fool it with every strange transaction I could imagine. The error checks within Quicken corrected my attempted mistakes. When the data was accurate in Quicken, passPort accurately translated it for PortfolioCenter every time.

What does it cost?

To use passPort, you need to buy Quicken, the Standard or TD Ameritrade Interface from Schwab Performance Technologies and a passPort license. After that, the only ongoing fees are licenses renewals and/or Quicken upgrades.

In case you are wondering, this post was not sponsored. I contacted Arcons Technology and asked for a demo. The opinions above are my own and I was not compensated in any way.