by Krisan Marotta | Oct 27, 2011 | KBO, Random Musings

According to an analysis by Paladin Registry in July, 2011, when choosing their financial advisor, 57% use a subjective approach, 31% use an objective approach and 10% have no process. In his ByAllAccounts blog post How Investors Select Financial Advisors (October...

by Krisan Marotta | Oct 15, 2011 | KBO, SEC Audits

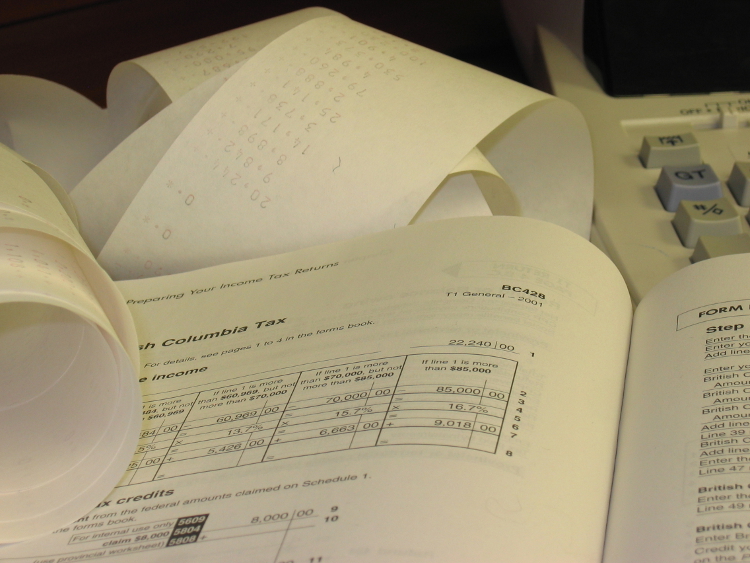

Mid-size RIAs may want to read the blog post by Chris Winn & Greg Brown from AdvisorAssist on the SEC to State Transition at the ByAllAccounts blog. Their post contains the critical dates for compliance and when to transition. In July 2010, President Obama signed...

by Krisan Marotta | Oct 5, 2011 | KBO, Reporting

September 2011 ended the worst quarter in terms of performance returns since I started working with PortfolioCenter in 1992. What PortfolioCenter reports could you send your clients to explain that while their portfolios are down, the drop does not necessarily...

by Krisan Marotta | Sep 23, 2011 | Cost Basis, KBO

Historically you may have used the trade lot matching method of “First in, First Out” or “Highest Cost” in order to produce the smallest possible capital gain or the largest possible capital loss when selling positions in client accounts. Trade...

by Krisan Marotta | Sep 15, 2011 | KBO, Performance

A corporate action is an event such as an exchange, merger, stock split or spin-off that affects the securities of a public traded company. Frequently corporate actions result in fractional shares which are converted to cash. This conversion generates a transaction...