Articles

What does the 2014 Fixed Income Cost Basis Legislation mean?

Some of the 2008 cost basis regulations were postponed. The delay is over. New rules are phasing in. What do they mean for PortfolioCenter?

Outsourcing a necessity for new advisors

Not outsourcing fails to realize the opportunity cost of doing more things yourself rather than focusing on building your firm. It is penny-wise and pound-foolish.

What is Internal Rate of Return?

What is Internal Rate of Return and how do I make sense of it?

PortfolioCenter Invoice does not match the Billing Summary?

The paper invoice does not match the amounts in the CSV file that I export from PortfolioCenter. How could the numbers fail to match?

What is Cost Basis?

If you are new to PortfolioCenter and confused about the basics of cost basis, here’s a refresher course.

Why is the yield zero on the Portfolio Statement report?

Why would a yield be zero on the Portfolio Statement? The yield is about 4% and the report shows 0%. Can you help?

What does “yield” mean on PortfolioCenter reports?

This seemingly simple term can be rather confusing, especially when numbers for the same security differ on different reports.

Cost basis updated on sold shares?

Will PortfolioCenter automatically receive updated cost basis information for shares which have been sold if the information has been updated at the broker?

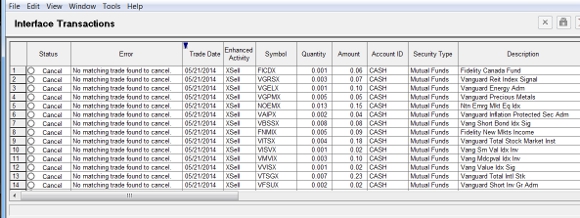

PortfolioCenter Error: “No matching trade found to cancel”

What do you do when a broker sends cancels for trades that do not exist in PortfolioCenter? Here’s how to trouble shoot it.

What’s the difference between Time Weighted Return and Internal Rate of Return?

PortfolioCenter provides two main performance calculations: Internal Rate of Return (IRR) and Time-Weighted Rate of Return (TWR). What’s the difference?

SEC Audit: 5 ways to prepare PortfolioCenter

The SEC is coming to visit. Here are 5 ways to streamline your PortfolioCenter database so you’ll be ready.

Why is there a positive Dollar Gain and a negative Time Weighted Return? Or vice versa?

A positive Dollar Gain and a negative Time Weighted Return (or vice versa) occur more frequently than you might expect. Here’s how it happens.

Get Started