by Krisan Marotta | Feb 18, 2012 | Cost Basis

When the cost basis reconciliation tools became available with PortfolioCenter 5.2, we began learning how difficult it is to keep the cost basis in the PortfolioCenter software in sync with the broker’s cost basis. Maintaining cost basis in both systems...

by Krisan Marotta | Feb 13, 2012 | Cost Basis

Tracking cost basis in PortfolioCenter software is an increasingly time-consuming proposition. As brokers provide more accurate cost basis numbers through their downloads, we are seeing with increasing clarity how difficult it is to maintain a duplicate system in...

by Krisan Marotta | Feb 9, 2012 | Cost Basis

Q.How do I get PortfolioCenter to treat the cost basis of an inherited security as “long term”? If I sell the security before a year has passed, the realized gains report classifies it as short term. A. First, make sure you have the right cost basis. ...

by Krisan Marotta | Jan 13, 2012 | Cost Basis

Bifurcation threatens to be the monster that devours all your time! If you reset your cost basis in PortfolioCenter to move out of average cost accounting January 1 2012, what do you do with transactions that arrive in January but which are backdated to December? ...

by Krisan Marotta | Jan 5, 2012 | Cost Basis

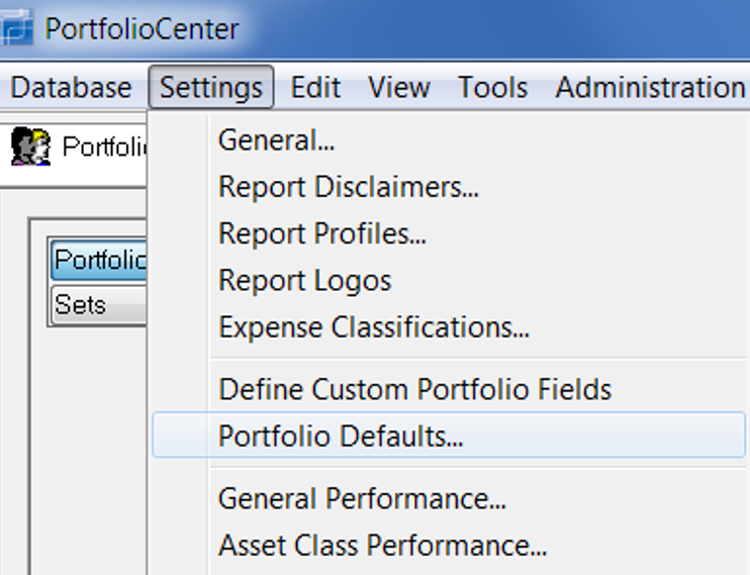

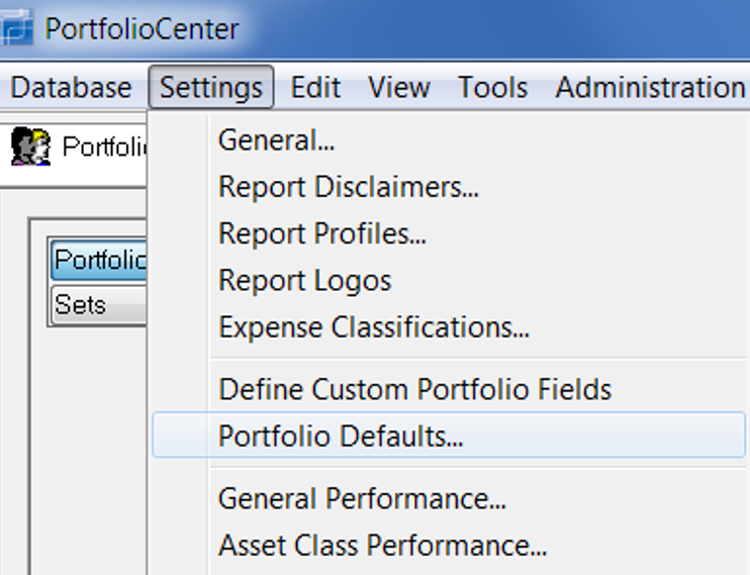

There’s an additional step you may need to take which is not discussed in the PortfolioCenter documentation for dealing with the bifurcation of average cost mutual funds. If you plan to switch from average cost accounting long term, you should change your...

by Krisan Marotta | Jan 2, 2012 | Cost Basis

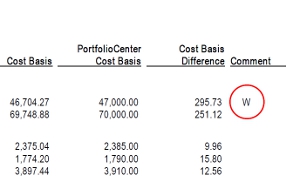

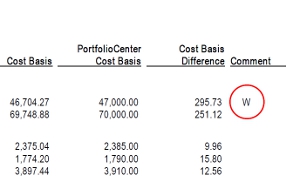

Wondering what the “W” means that has begun appearing in the comment field on the cost basis reconciliation report in Schwab’s PortfolioCenter? It means that position is affected by a wash sale. If you sell a position at a loss and purchase that...