by Krisan Marotta | Dec 29, 2011 | Cost Basis

If you sell a position at a loss and purchase that position again 30 days before or 30 days after the sell, the IRS considers this a “wash sale” and the investor is not allowed to take the realized loss. To maintain accurate cost basis in Schwab’s...

by Krisan Marotta | Dec 27, 2011 | Cost Basis

With the new IRS tax reporting regulations, average cost positions will be bifurcated. Thanks to government regulation, covered and uncovered shares will now maintain a separate average unit cost which require manual data entry in PortfolioCenter to maintain accurate...

by Krisan Marotta | Dec 11, 2011 | Cost Basis

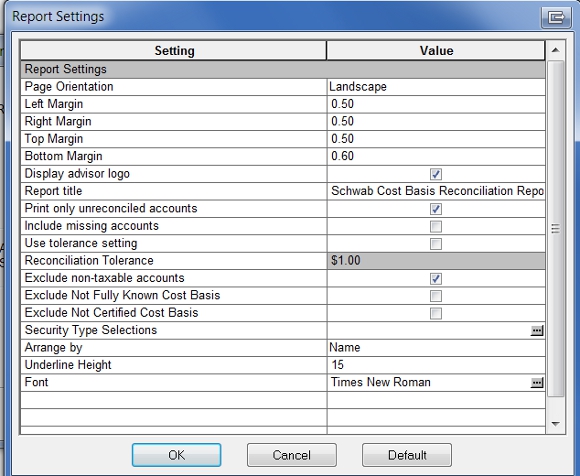

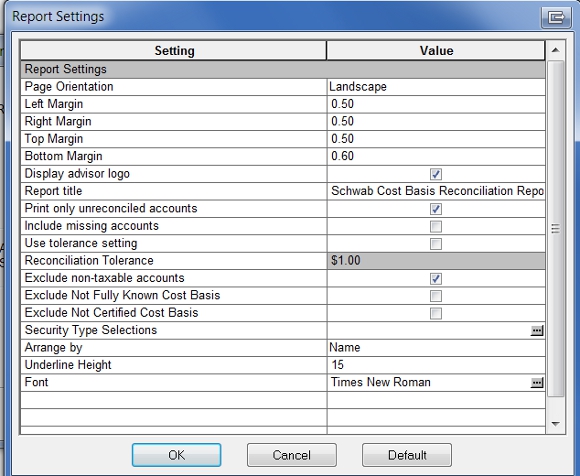

Wondering which settings to use on the Cost Basis Reconciliation Report in PortfolioCenter? These are the ones I find most useful: CHECK – Print only unreconciled accounts By default, the Cost Basis Reconciliation report shows only positions that fail to...

by Krisan Marotta | Dec 5, 2011 | Cost Basis, Most Popular

Thanks to increased federal regulations, many custodians are providing cost basis information in the files downloaded to PortfolioCenter. Now you have two systems to keep up to date! Fortunately, you can compare the cost basis information downloaded from the...

by Krisan Marotta | Sep 23, 2011 | Cost Basis

Historically you may have used the trade lot matching method of “First in, First Out” or “Highest Cost” in order to produce the smallest possible capital gain or the largest possible capital loss when selling positions in client accounts. Trade...

by Krisan Marotta | Aug 11, 2011 | Cost Basis

Need to calculate cost basis for a position but unsure how? Here’s the math. Cost basis is defined as the original price of an asset. It is the number used in determining capital gains. Cost basis is usually the purchase price including all fees, but it can be...