by Krisan Marotta | Aug 22, 2014 | Performance

Q. I’m confused about how the taxable flag should be set for the various fixed income securities. Everything seems to come in marked as taxable. Can you help? A.For most brokers new fixed income securities default to state taxable “yes” and federal...

by Krisan Marotta | Aug 4, 2014 | Performance

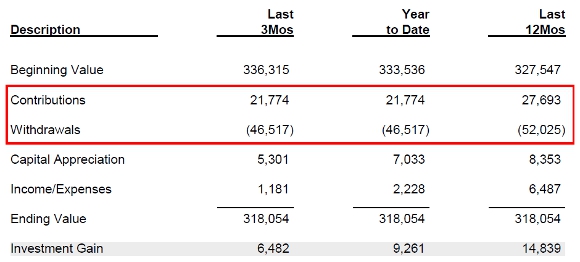

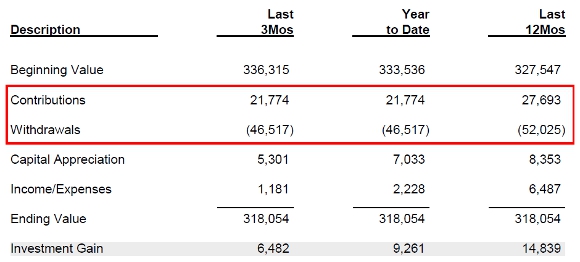

After receiving their PortfolioCenter quarterly reports, the most frequent question from clients usually concerns the net contributions/withdrawals. (“But I didn’t take out that much money?!”) The total contributions and withdrawals on...

by Krisan Marotta | Jul 21, 2014 | Performance

Internal Rate of Return (IRR) is the single rate of return at which the beginning market value plus additions grows to equal the ending market value minus withdrawals. PortfolioCenter calculates IRR using an “iterative process”. Basically PortfolioCenter...

by Krisan Marotta | May 27, 2014 | Performance

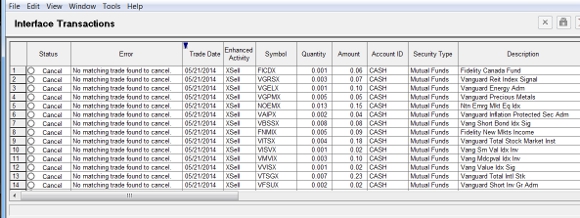

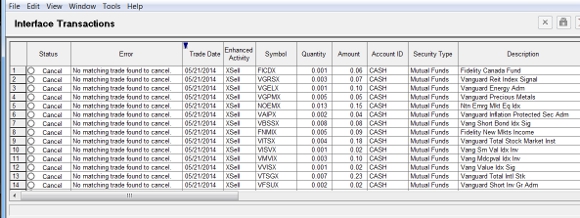

You’ve probably seen the error “No matching trade found to cancel” when posting transactions in one of the PortfolioCenter interfaces. Typically, you’ll see this error when a broker is making a correction. In my experience Schwab is the most...

by Krisan Marotta | May 19, 2014 | Most Popular, Performance

PortfolioCenter provides two main performance calculations: Internal Rate of Return (IRR) and Time-Weighted Rate of Return (TWR). What’s the difference? IRR measures the overall growth of the portfolio. If your goal is to reach a $1 million by age 65, IRR...

by Krisan Marotta | May 9, 2014 | Performance

How can there be a positive Dollar Gain (DG) and a negative Time Weighted Return (TWR)? Or vice versa? These “strange but true” returns occur more frequently than you might expect. First, remember that TWR measures the growth of the average dollar in a...