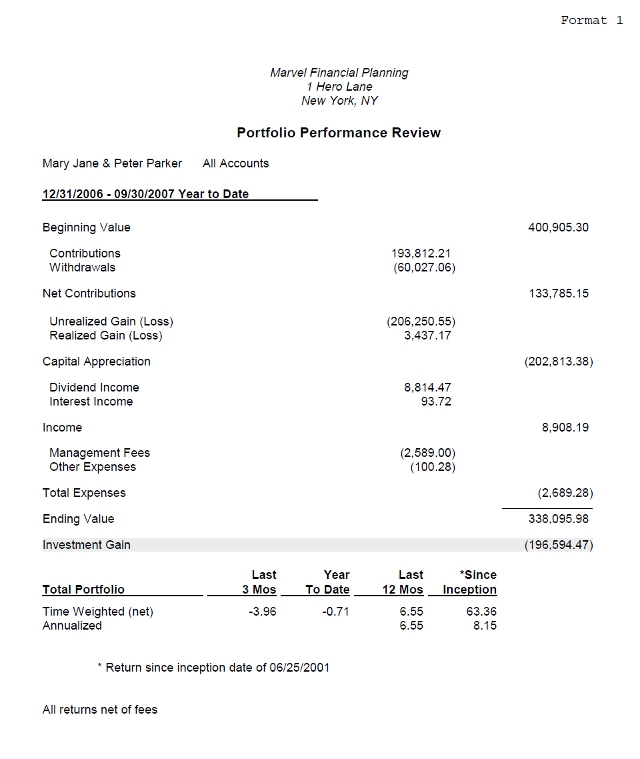

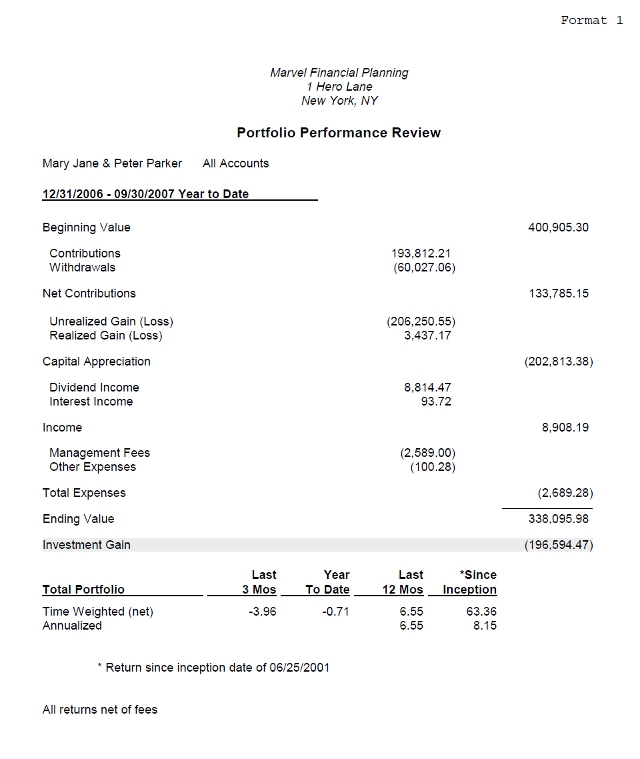

Producing the PortfolioCenter performance reports requires correct data entry and a series of calculations based on that data. Here’s a brief overview of the basic math.

Beginning (BV) = The total market value of the portfolio at the beginning of the reporting period. This values comes from the intervals, except in the Position Performance Summary, where the beginning and ending values are computed directly.

Net Contributions (NC) = The total of all securities and cash deposits added to or subtracted from the portfolio during the reporting period.

NC = Contributions + Withdrawals

Contributions (C) = Cash deposits plus the market value of securities deposited into the portfolio during the reporting period.

C = Cash deposits (dollar value) + Market value of Receipts of Security + Flows created from movement between unmanaged and managed assets (Principal cost + brokerage fees + other fees + accrued interest)

Withdrawals (W) = Cash withdrawals plus the market value of securities transferred out of the portfolio during the reporting period.

W = Cash withdrawals (dollar value) + Market value of Transfers of Security + Flows created from movement between unmanaged and managed assets (gross proceeds – brokerage fees – other fees + accrued interest, if applicable) + Expenses unchecked to reduce both gross and net returns

Note: If you are reporting on a group Contributions and Withdrawals may also include cash and securities transferred between accounts in the group, depending on the settings you have checked.

Capital Appreciation (CA) = The change in value, excluding additions and withdrawals, during the reporting period.

CA = Unrealized Gains (Losses) + Realized Gains (Losses) + Transfers

Realized Gains (RG) = Total of the capital gains realized on the sale of securities during the reporting period (not from the purchase price)

RG = Net Proceeds of Securities Sold – Beginning Market Value of Securities Sold + any Gain Distributions

Unrealized Gains (UG) = Total change in value during the reporting period (not from the purchase price)

UG = (Ending Market Value) – (Beginning Market Value) – (Net Contributions ) – (Transfers) – (Income) – (Realized Gain) – (Change in Accrued) – (External Fee Payments) – (Expenses)

Transfers (T) = The total of all movement into or out of the portfolio that is not a net contribution during the reporting period. For example if a security is sold prior to the beginning date of the report and it pays a dividend during the reporting period, the dividend may be counted as a transfer. Typically these movements net to zero and this line does not appear.

T = Credits – Debits ± Journals + Odd Income ± Trades to ‘None’ + Accrued Income ‘not displayed’

Note: Performance reports and tax reports are different flavors. Performance reports calculate the un/realized gain/loss by subtracting the beginning market value from the gross proceeds; tax reports subtract the cost basis from the gross proceeds. The un/realized gain/loss numbers on Performance reports rarely match those on tax reports.

Income (I) = Total of Dividend Income + Interest Income during the report period

Interest Income = Total interest received during the report period.

Dividend Income = Total dividends received during the report period.

Total Expenses = Total of Management Fees (including external fees) + Other Expenses during the report period.

External Fee Payments = Total of all Management Fees paid by check or cash instead of deducted from the account. This value appears on the report only if a deposit and a management fee for the same dollar amount occur in the same account on the same date.

Other Expenses = (Total Expenses) – (Management Fees) during the report period.

Management Fees = Total expenses marked as management fees during the report period.

Change in Accrued (CH) = Net change in accrued interest on fixed income securities during the report period.

CH = (Ending Accrued) – (Beginning Accrued) – (Accrued Paid)

Beginning Accrued = Total accrued interest for fixed income, mortgage backed and CDs + total accrued dividend for equity, user defined and unit trust at the beginning of the reporting period.

Accrued Paid = Total of the accrued paid field on buys of fixed income, mortgage backed and CDs during the report period.

Ending Accrued = Total accrued interest for fixed income, mortgage backed and CDs + total accrued dividend for equity, user defined and unit trust at the end of the reporting period

Ending Value (EV) = The total market value of the portfolio at the end of the reporting period. This values comes from the intervals.

Investment Gain (IG) = The dollar amount that makes this formula true for the reporting period: BV + C – W + IG = EV