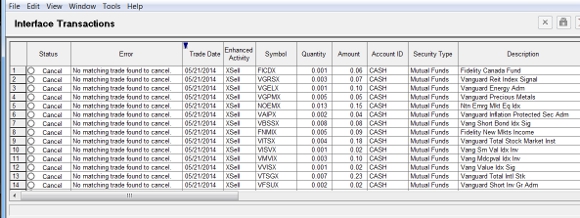

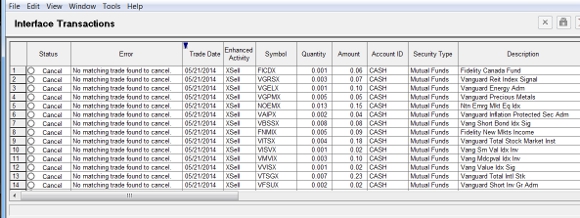

You’ve probably seen the error “No matching trade found to cancel” when posting transactions in one of the PortfolioCenter interfaces.

Typically, you’ll see this error when a broker is making a correction. In my experience Schwab is the most accurate in handling corrections and you can usually post Schwab cancellations with confidence; Fidelity and TD Ameritrade corrections almost always need manual adjustment.

How to trouble shoot “no matching trade”:

For PortfolioCenter to process a cancelled trade EVERY field on both transactions must match exactly. Knowing that solves 75% of the problems.

Step 1#: Check for field mismatch.

Go to the transactions ledger of the account(s) in question and look for a similar trade.

The Date Field is a likely culprit. Fidelity and Ameritrade tend to use today’s date on the cancellation rather than the original trade date. In that case, adjust the date of the cancellation transaction to the match the date of the original transaction and post the interface file.

The other likely culprit is the Broker Fees. To correct a fee, the broker should send 2 transactions: 1 cancellation transaction with the incorrect, original fee and 1 new trade with the proper fee. However, both Fidelity and TD Ameritrade typically send 1 cancellation transaction with the new fee. In this case, the easiest solution is usually to block the cancellations in the interface and manually adjust the fee on the original transaction.

But what if you receive cancellations for trades that do not exist in PortfolioCenter? There is no trade to adjust in PortfolioCenter because nothing is even close?

Step #2: Figure out the broker intended, then make appropriate changes.

To solve this riddle, you have to decipher what happened in reality. To do that, run a reconciliation report for the day before the cancellations and ensure everything reconciles up to the day in question. Then post everything else except the offending cancellations and run a reconciliation report. Your goal is to figure out what the broker intended to do.

For example, my screenshot above shows a series of SELLs for trades that do not exist in PortfolioCenter. In fact, there had been no SELLs for months in this account. The reconciliation report revealed the broker – Fidelity in this case — now held more fractional shares for these positions than PortfolioCenter and the money markets still reconciled to the penny. This tells me Fidelity intended to give the client more shares.

Checking the client’s transaction ledger revealed a series of BUYS for these funds two days earlier. Since everything reconciled the day before, I could reasonably conclude Fidelity intended to adjust the share quantity of the recent BUYS to give the client more fractional shares. Fidelity should have sent a cancellation of the original BUY and a new BUY with the corrected share quantity. Instead they sent a cancelled SELL for fractional shares.

At this point, you have two options. You can call and complain to your broker, then manually correct the original trades. Or you can just manually correct the original trades.

Need help?