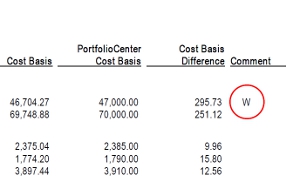

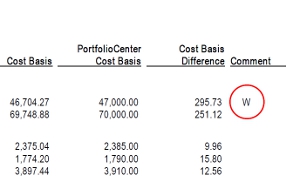

Wondering what the “W” means that has begun appearing in the comment field on the cost basis reconciliation report in Schwab’s PortfolioCenter?

It means that position is affected by a wash sale.

If you sell a position at a loss and purchase that position again 30 days before or 30 days after the sell, the IRS considers this a “wash sale” and disallows the investor to take the benefit of a realized loss.

If you reconcile PortfolioCenter cost basis with your custodian’s data, you need to adjust for wash sales. However, if you are using the average cost matching method, you will not be able to make these adjustments.

The adjustment involves three steps:

- Verifying the amount washed

- Adjusting the amount of realized loss to zero

- Adjusting the cost basis by the amount of the wash and setting the original trade date remaining position to the date of the washed trade lot

For details see:

Handling Partial Wash Sales

Cost Basis Reconciliation Checklist

Need a quick answer? Ask a question and I’ll try to answer with a blog post.